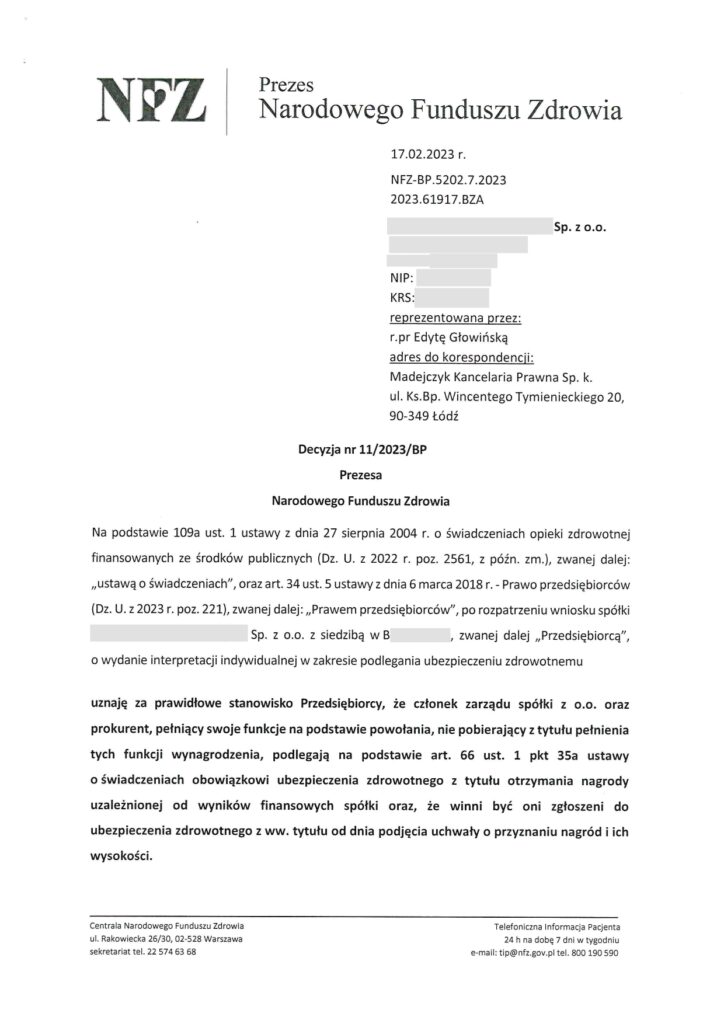

Choosing the legal form in which to run your business is a major decision. If he chooses poorly you can bear too much risk, even with all your assets. Imagine losing everything after a dozen years of doing business because you didn’t choose the right way to do business. What’s more, if you don’t thoroughly think through your choice of business form, you may pay too much in taxes, which can make your business less competitive.

The legal form of your business is the foundation around which you can build your company, make sure you have the right foundation.